Automate & optimize your customer onboarding process

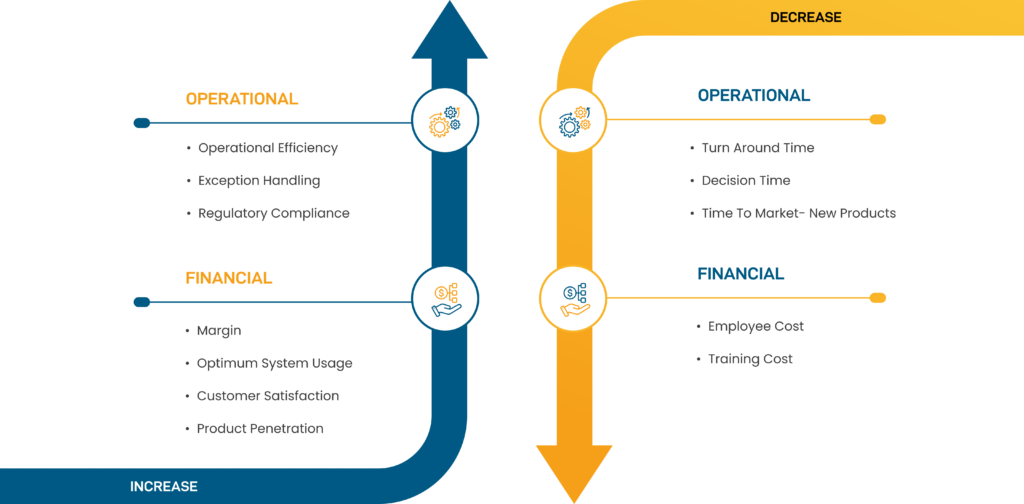

Automate and optimize the customer onboarding process reducing errors. From integrated e-signatures to identity & anti-money laundering checks.

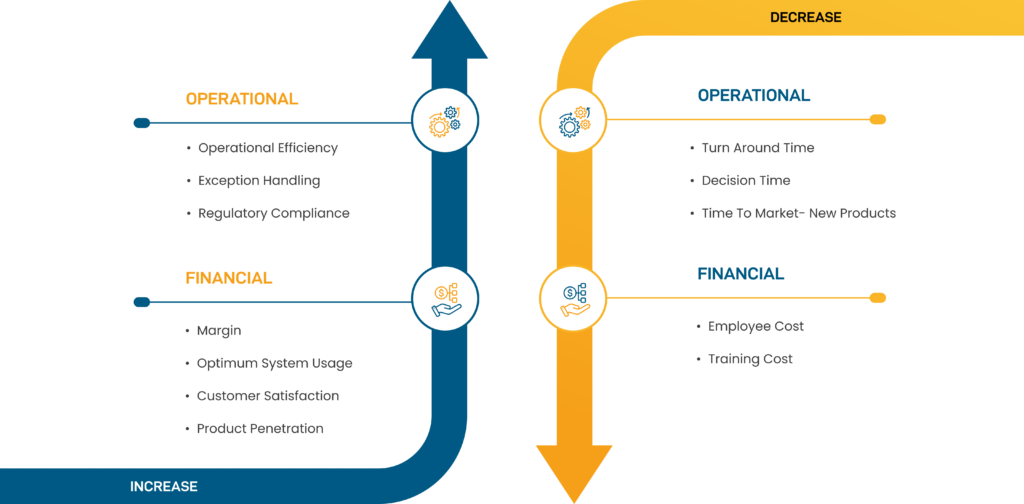

Fast customer on-boarding

Accurate digital workflows

Risk reduction

Maintain control without burden

Our solutions support the overarching mission of bridging the financial inclusion gap in the country.

Quickly verify the identity of potential customers, which ensures compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations.

Allows creation of a user-friendly interface for customers to complete application forms online and answer relevant questions, such as information about income, expenses, and credit history.

Enables customers to securely upload and store supporting documentation, such as ID proofs, financial statements, and employment records.

Permits customers to sign legally binding documents electronically through Aadhar e-Signatures, streamlining the process and reducing the need for physical signatures.

Performs a credit check and risk assessment on potential customers, helping the financial institution make informed lending decisions.

Manages the flow of tasks and approvals, ensuring that the customer onboarding process runs smoothly and efficiently.

Integrates the digital customer onboarding solution with the financial institution’s existing systems, such as accounting and loan management systems.

Manages user access to the system, ensuring that sensitive customer data is protected.

Facilitates access to real-time data and insights into the customer onboarding process, helping the financial institution identify areas for improvement and make informed decisions.

Provides multi-channel accessibility for customers, enabling them to complete the onboarding process from their personal devices or platforms.