Striking the perfect balance between efficiency and compliance.

Crown CKYC solution is a game changer, tried & tested platform utilizing advanced digital technologies for onboarding, precise parsing, secure data transactions, audit trail and reporting to reduce costs, Turn-around-times, errors and risks – perfect for the financial services industry.

Integrate with banking or loan management systems

Adapt to your changing demands

Leverage AIML capabilities

Accurate & detailed insights

CKYC makes use of advanced digital technologies to accurately capture information and images from the documents, create data entry, and upload multiple entries at one go using batch uploads allowing your organisation to focus on acquiring and servicing customers more efficiently, helping grow client satisfaction.

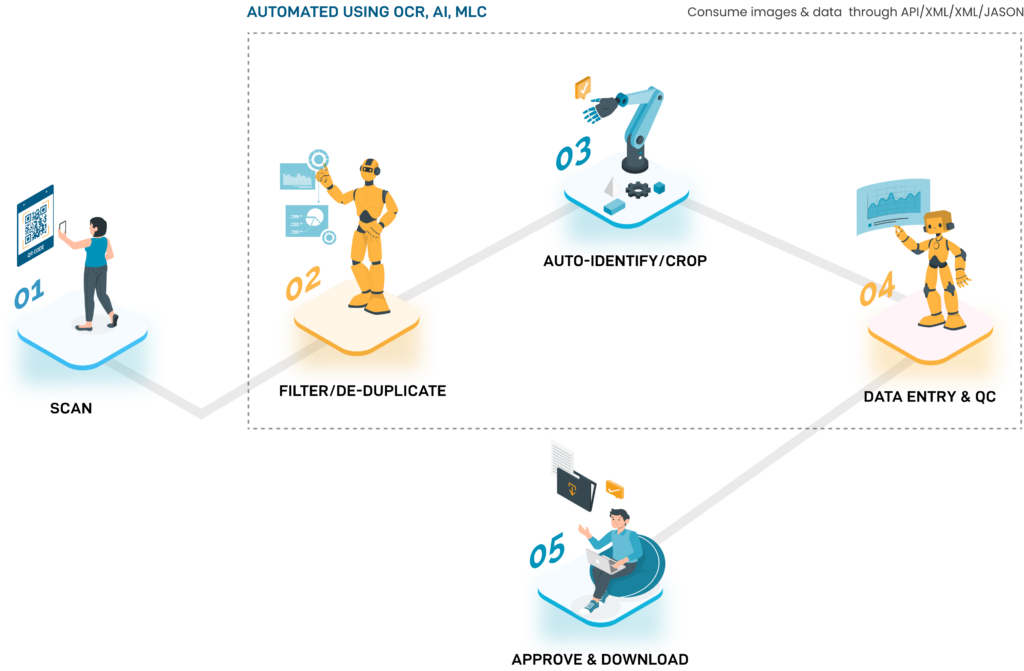

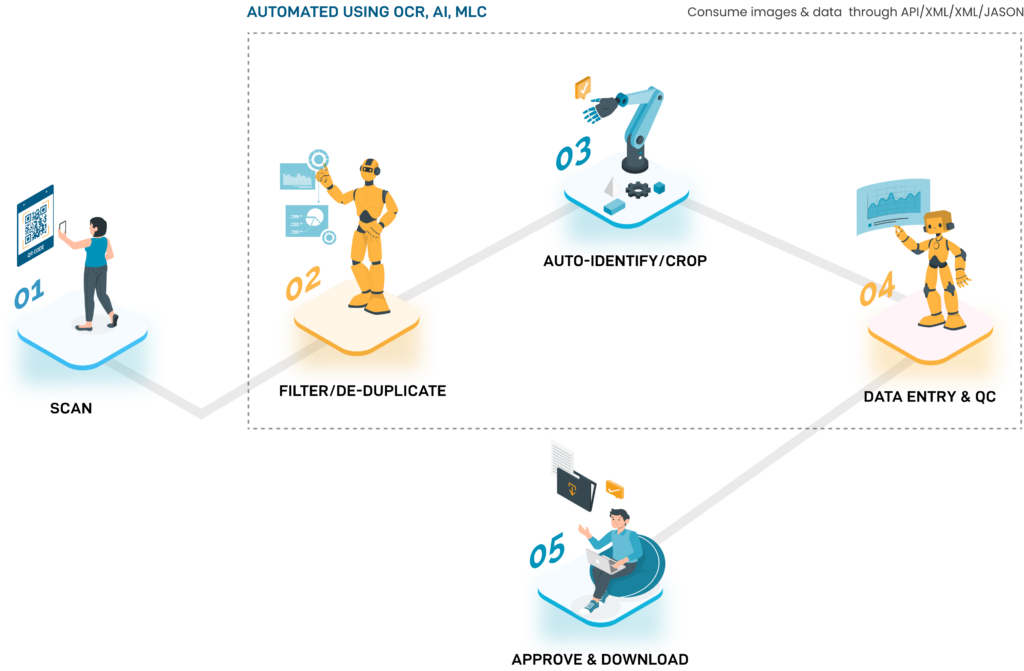

As per the mutually decided Standard Operating Procedure, our team can establish a scan station at the client branch. Alternatively, the client can use its team to scan application forms, along with POA (Proof of Address) and POI (Proof of Identity). After completing the scanning activity, these images can be transferred to Crown Centralized Processing Centre through a dedicated Secure File Transfer Protocol (SFTP) along with data sheets of each application form in the prescribed format.

After the scanned images arrive at our centre, we will browse the institution’s master records to check if the CKYC process is already performed for a particular customer ID.

With the help of a dedicated offline tool, Crown will process the remaining records (which do not have a CKYC ID) to identify photo, POA and POI automatically and crop them as per prescribed dimensions from Central Registry of Securitisation Asset Reconstruction and Security Interest of India.

The process starts with data entry for each record, which can either be imported from the institution’s master records or can be done manually. This process is done on Crown’s web-based tool which then creates an individual zip folder for each application form as prescribed by Central Registry of Securitisation Asset Reconstruction and Security Interest of India.

The reports can be downloaded after the data is uploaded to Central Registry of Securitisation Asset Reconstruction and Security Interest of India SFTP location.

A Quality-check (QC) is performed for each record to ensure that all images are scanned and cropped following Central Registry of Securitisation Asset Reconstruction and Security Interest of India guidelines. If a record fails to meet the QC norms, it is sent back for re-scanning or data entry.

All the records processed are approved for batch upload. The system will then generate flat files and zip files following guidelines provided by Central Registry of Securitisation Asset Reconstruction and Security Interest of India. A digital signature is applied on the day’s batch and the ready files are pushed to Central Registry of Securitisation Asset Reconstruction and Security Interest of India SFTP location.